Amag with record earnings in Q1 2022

Austrian Amag reports a record result for Q1 2022 and expects high uncertainties for the rest of the year.

In the first three months of 2022, Amag Austria Metall AG has successfully continued its positive performance from the 2021 financial year and achieved the highest level of quarterly earnings in the company’s history.

Record earnings in the 1st quarter 2022

This positive trend especially reflects significant growth in shipment volumes and product mix optimisations at the Ranshofen site. A very high aluminium price level is also having a positive impact on earnings in the Metal Division.In particular, the significant increase in sales volumes and product mix optimisations at the Ranshofen site were responsible for the positive development, the company said in a statement. A very high aluminium price level also had a positive effect on the result in the Metal segment. Amag group revenues reported marked growth to EUR 399 m (Q1/2021: EUR 251.2 m) thanks to both higher shipment volumes and the significantly higher aluminium price. In detail, shipment volumes of 104,600 t represent growth of more than 6 % compared to the same quarter of the previous year (Q1/2021: 98,500 t).

The Metal Division benefited from both stable production levels and a high aluminium price. In a challenging market environment, the Casting Division maintained its high level of shipment volumes from the first quarter of 2021 and additionally benefited from a positive price trend. In the Rolling Division, continued high demand for aluminium rolled products was leveraged for further growth. Shipment volumes were up by almost 11 % to 60,100 t (Q1/2021: 54,300 t). The division’s high level of productivity, optimisations in its product mix and a positive price trend, especially in the industrial applications area, are clearly reflected in its earnings.

Positive operational development with high productivity and good capacity utilisation

The division’s high level of productivity, optimisations in its product mix and a positive price trend, especially in the industrial applications area, are clearly reflected in its earnings. After taking into account depreciation and amortisation of EUR -21.6 million, Amag group reported a fivefold increase in earnings before interest and taxes (Ebit) to EUR 46.3 m (Q1/2021: EUR 9.3 m). Earnings after taxes of EUR 32.5 m reflect an excellent first quarter of 2022 (Q1/2021: EUR 5.1 m).

Outlook 2022 marked by uncertainties

Despite an excellent start to 2022, the further outlook is characterised by elevated uncertainties, particularly due to the Ukraine conflict and Covid-19-related lockdowns (as currently in China). Labour shortages as well as impaired supply chains remain challenging. Gerald Mayer, CEO of Amag Austria Metall AG, comments: “The start to 2022 has been successful in operational terms. We were able to leverage the positive market environment and generate the highest quarterly earnings in AMAG's history. The order intake situation is at a very good level and secured for the coming months. Amag's future business performance depends to a large extent on general economic developments and, at the Ranshofen site, on energy supply risks. Nevertheless, we currently expect full-year Ebitda to exceed EUR 200 million.”

Amag Austria Metall, Ranshofen, is investing more than EUR50 million in a new state-of-the-art line for surface treatment of aluminium strips.

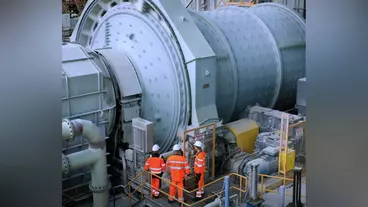

Metso will deliver six semi-atugenous grinding (SAG) mills to a bauxite application in China to support a low-carbon aluminium industry project.

Replacing a LPG furnace with a combination of an electric resistance furnace and an induction furnace improves energy efficiency and reduces CO2 emissions.